flow through entity tax break

The earnings of PTEs are therefore only subjected to income tax one time at the owner level. The Flow-through Entities Tax section is a compilation of alerts and articles written by members of the ICPAS Flow-through Entities Tax Committee.

The Accounting Equation Is The Best Methods In Principle Of Accounting Accounting Accounting Basics Accounting Education

Accordingly S corporations partnerships LLCs and sole proprietorship are collectively referred to herein as pass-through entities PTEs.

. Up to 25 cash back By Stephen Fishman JD. Simple Fair and Pro-Growth. Flow-through entities are used for several reasons including tax advantages.

Some key takeaways for tax and accounting professionals include. It provides owners of flow-through trades or businesses often called pass-through entities a significant tax break to rival the new lower tax rate for C corporations. Proposals to Fix Americas Tax System Report of the Presidents Advisory Panel on Federal Tax Reform November 2005.

PTEs and their owners should take these taxes into account when determining the impacts at the entity and owner levels. Tiered Entities Material participation is based on the. The MI flow-through entity tax is retroactive to Jan.

Calendar year 2021 has continued the trend of pass-through entity PTE tax proposals. According to information released by the state the flow-through entity tax allows certain flow-through entities to elect to file a return and pay tax on income in Michigan and allows members or owners of. Passive Activity A trade or business in which.

The Tax Cuts and Jobs Acts addition of Section 199A As part of the Tax Cuts and Jobs Act Congress created Code Section 199A providing owners of flow-through businesses and sole proprietors with a potential deduction thereby allowing them to be more competitive with C Corporations which under the Act saw tax rates reduced from 35 to 21. Follow the links below for more information on these topics. 2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest.

The after-tax cash flows to an owner can be materially different depending on the entity form as illustrated. Rules for Flow-Through Entities. Report of the National Commission on Fiscal Responsibility and Reform December 2010.

Wheres my tax break jen. Recent Comprehensive Tax Reform Proposals. Many small businesses are set up as flow-through entities meaning the income from these businesses is taxed at the owner of the businesss tax rate instead of taxed separately.

We dont know how the new tables are going to look but based on the current tables a 25 rate would be favorable at single income of 91901 and married joint of 153101 but it really doesnt. Flow-through Entities Tax Articles. With the fast approaching state tax compliance deadlines PTEs and their owners are intensifying their attention on these taxes.

Flow through entity tax break. In the end the purpose of flow-through entities is the. Consequently a taxpayers basis is often scrutinized by the IRS particularly when basis is claimed based upon debts incurred by a flowthrough entity.

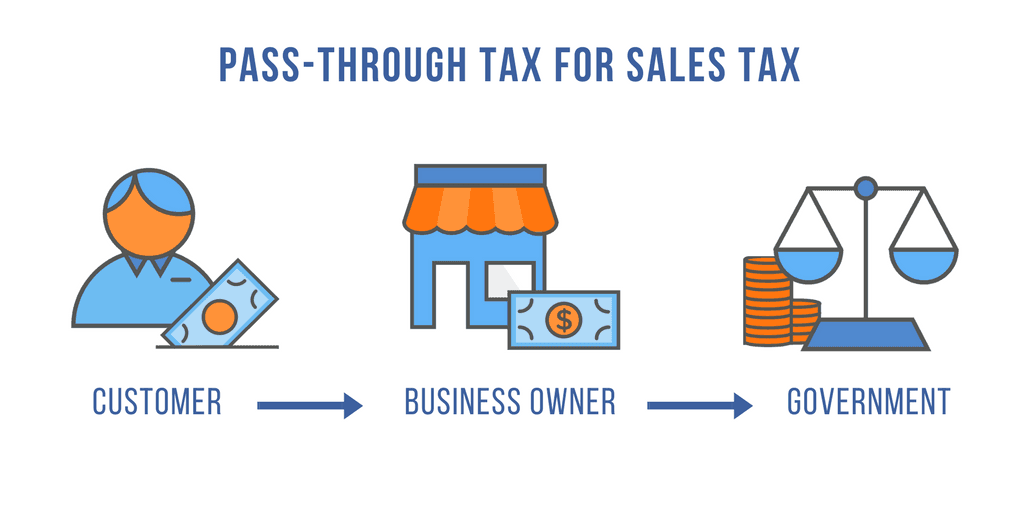

Because your business pays its taxes through your individual tax return it is known as a pass-through entity. The tcja includes a significant tax break for these types of entities due to the section 199a deduction also known as the 20 qualified business income deduction qbid but the rules for this deduction are far from simple. A pass-through entity is any type of business that is not subject to corporate tax.

Subsequent tax years is generally not. The Moment of Truth. The income of the business entity is the same as the income of the owners or investors.

As well as links to websites and other resources of interest to the flow-through entities tax community. 1 2021 for certain electing flow-through entities and those entities may be required to pay quarterly estimated tax payments. As a result individuals.

Flow-through entities are considered to be pass-through entities. Flow-through entities are different from C corporations they are subjected to single taxation and not double taxation. The purpose of flow-through tax forms is to attach income to a tax-paying entity namely you.

The Tax Cuts and Jobs Act TCJA the massive tax reform law that took effect in 2018 established a new tax deduction for owners of pass-through businesses. Fourth quarter estimated tax payment for calendar year flow-through entities electing into the tax. This is done via the Schedule K-1 on Form 1120S.

If you own a business chances are that you not the business itself are responsible for paying taxes on the profit generated by the business. The law signed by Whitmer on Dec. Llcs are what is known as a flow through entity.

Understanding What a Flow-Through Entity Is. The income of the owners of flow-through entities are taxed using the ordinary. This means that the flow-through entity is responsible for the taxes and does not itself pay them.

Taxpayers with ownership interests in flowthrough entities cannot deduct entity losses if they do not have basis in those entities. Pass-through owners who qualify can deduct up to 20 of their net business income from their income taxes reducing their effective income tax rate by 20. 20 PA 135 of 2021 amends the state Income Tax Act to create a flow-through entity tax in Michigan.

A flow-through entity is also called a pass-through entity. For the large corporations the Tax Reform reduced the tax rate from 35 to a flat tax rate of 21 for entities taxed as a C Corporation. The tax break allows owners of pass-through businesses like sole.

The Tax Cuts and Jobs Act signed by former President Donald Trump in 2017 created the so-called pass-through deduction. Participate Any rental without regard to whether or not the taxpayer materially participates A single entity could have more than one activity. Often the owners of a corporation must take a distribution in order to pay their corporations taxes.

However the late filing of 2021 FTE returns will be accepted as timely if filed within 6 months of the due date.

What Is Input Tax Credit Or Itc Under Gst Exceldatapro Cash Flow Statement Accounting Tax Deductions

S Corp Tax Return Irs Form 1120s White Coat Investor In 2021 Irs Forms Tax Return White Coat Investor

Welcome To Black Ink Tax Accounting Services We Hope To Provide You With Timely And Valuabl Accounting Services Tax Preparation Services Offer In Compromise

Benefits Of Incorporating Business Law Small Business Deductions Business

What The New Tax Bill Means For Small Business Owners Freelancers Small Business Tax Business Tax Deductions Business Tax

Pass Through Taxation What Small Business Owners Need To Know

Tax Advantages Of Esops Employee Stock Ownership Plan Business Leadership How To Plan

Cash Flow Formula How To Calculate Cash Flow With Examples Cash Flow Positive Cash Flow Formula

Deferred Tax Liabilities Meaning Example Causes And More Deferred Tax Financial Accounting Accounting Education

Fifo Meaning Importance And Example Accounting Education Accounting And Finance Accounting Basics

S Corp Tax Return Irs Form 1120s White Coat Investor In 2021 Irs Forms Tax Return White Coat Investor

Here Are Some Accounting Tips To Ensure An Error Free Accounting And Business Growth Accountingtips Accoun Cloud Accounting Accounting Accounting Software